#Ar turn over download#

Featured Resource: The Ultimate AR Collections Benchmarks Report Download the Report ➜Īnother way to assess how your AR process is working is to look at competitors. You may be aware of certain spikes or changes in your business that impact the ART, and being able to account for that as you look at how the ratio shifts will give you an indication of whether or not your AR and collections process is performing well. If you calculate it monthly, how has the number adjusted month over month? If you calculate it quarterly, compare the past few quarters. The first way to assess your ART ratio is to look at it in terms of other periods. Therefore it’s important to look at it in context of other information, which will help you assess how well the AR and collections process is working. The ART ratio alone may not be meaningful, as every industry is different and each business has its own terms for customer accounts. The Smith Company has an accounts receivable turnover of 13.45. The Smith Company has a beginning accounts receivable of $250,000 and an ending accounts receivable of $315,000.

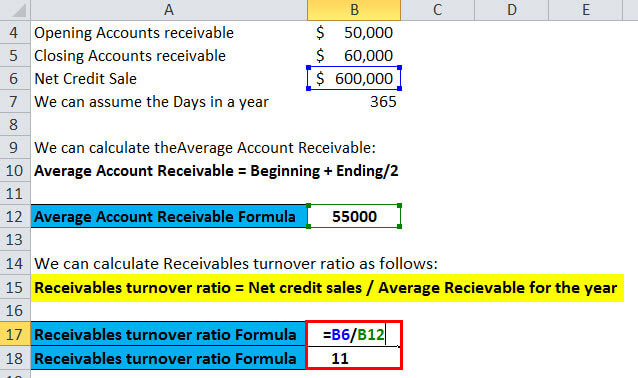

Net credit sales / net accounts receivable = accounts receivable turnover.Beginning accounts receivable + ending accounts receivable / 2 = net accounts receivable.To calculate the ART ratio, you need to choose what period of time your measuring and know the beginning accounts receivables for the period, and the ending accounts receivables for the period.

#Ar turn over how to#

➜ Measure Your AR Turnover Ratio With Our AR Collections Benchmarks Report How to calculate ART ratio? This number can be calculated on a monthly, quarterly or annual basis. The ratio shows how well a company uses and manages the credit it extends to customers, and provides a number for how quickly that short-term debt is paid. The account receivables turnover ratio (ART ratio) is used to measure a company's effectiveness in collecting its receivables or money owed by clients. Companies that maintain accounts receivables are essentially providing interest-free loans to their clients - accounts receivable is money owed without interest for the set term, which is often a 30 or 60 day period the client has to pay for the product.

0 kommentar(er)

0 kommentar(er)